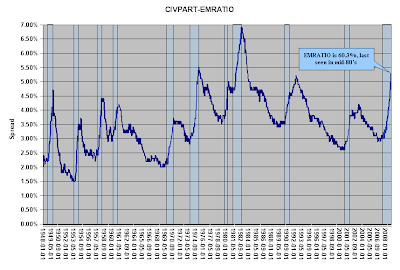

There I was, blissing on the latest chart and info posted on Calculated Risk, and the point was made by the commentariat (ht Evil Henry Paulson IIRC) that EMRATIO was the real tell regarding the state of the economy in the US...so I had to update my CIVPART-EMRATIO spread chart, which shows continued widening.

But then I got to thinking about the change in EMRATIO, so I smoothed things a bit by making a 3 Month Moving Average, and then took the Year Over Year change in that to generate the second plot. For rate of change, this recession is in there with the best of them and out does the double dip of the 80's - what it does not have (so far) is duration...