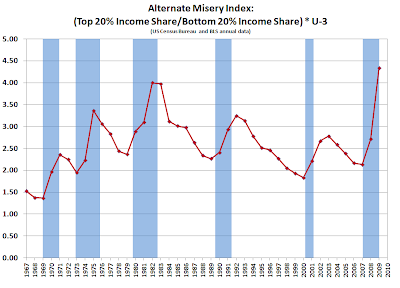

OK, so the commentariat over at Calculated Risk was kicking around conceps for an alternate misery index (or at least cinco-x and myself). If you will recall, the original misery index is the sum of the unemployment rate and the rate of inflation (Okun).

But in ZIRP world, inflation is not much of a factor even though misery we got aplenty, so what might be another approach to quantifying that? Above is one alternative, taking annual data from BLS for U-3 unemployment (well, that was monthly data taking an annual arithmetic average) and Census data for the ratio of the income share of the top 20% to the income share of the bottom 20% for the USA.

I think the 2010 numbers will be pretty close to the current set, so a conjecture for 2010 would be an approximately level line segment from 2009... though the most striking thing to me was the rate of change 2008-2009, I think the ripples are still propagating across the pond on that.